Discover what

financial freedom

feels like.

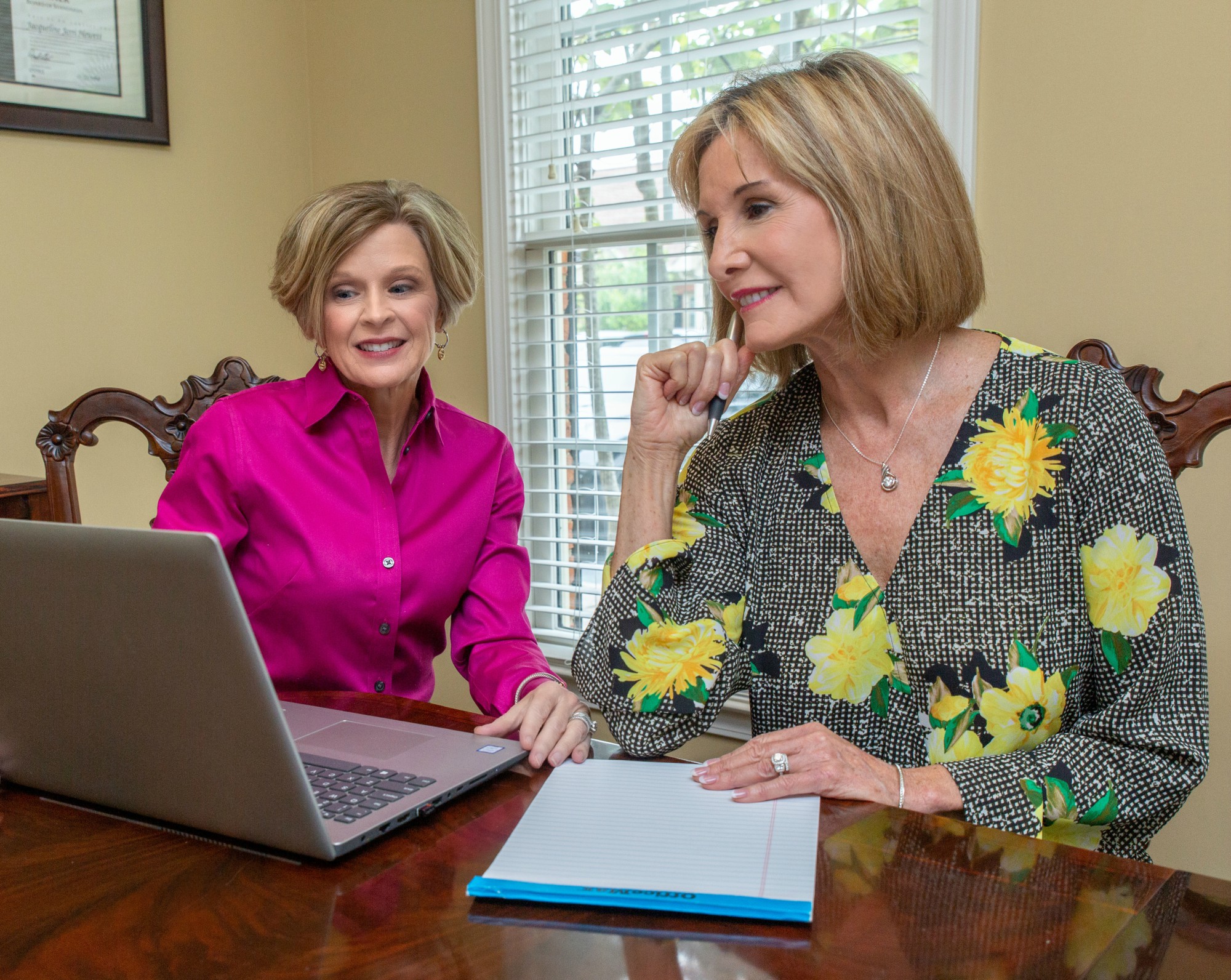

We will help you create a multifaceted plan that aligns your money with your life.

Discover what

financial freedom

feels like.

We will help you create a multifaceted plan that aligns your money with your life.

Work with Certified Industry Professional

Jerrí Hewett Miller CFP®, RICP, BFA

As Seen In

As Seen In

Are you seeking the confidence to move forward?

Schedule some time with us to talk and see if we’re a good fit for each other.

WEALTH HORIZON INC.

Office: (770) 840-8440

Email: lynn@wealthhorizoninc.com

Email: dan@wealthhorizoninc.com

Email: jerrí@wealthhorizoninc.com

200 Ashford Center North, Suite 400

Atlanta, GA 30338

Securities offered through LPL Financial, Member of the FINRA/SIPC. Advisory services offered through IFG Advisory, LLC., a Registered Investment Advisor. IFG Advisory, Integrated Financial Group, and Wealth Horizon, Inc. are separate entities from LPL Financial.

FIVE STAR Wealth Manager Award based on 10 objective criteria associated with providing quality services to clients such as credentials, experience, and assets under management among other factors. Wealth managers do not pay a fee to be considered or placed on the final list of 2014-2019 Five Star Wealth Managers.

Women’s Choice Award® Financial Advisors and Firms represent less than 1% of financial advisors in the U.S. As of January 2018, of the 848 considered for the Women’s Choice Award, 145 were named Women’s Choice Award Financial Advisors/Firms. The Women’s Choice Award Financial Advisor program was created by WomenCertified Inc., the Voice of Women, in an effort to help women make smart financial choices. The program is based on 17 objective criteria associated with providing quality service to women clients such as credentials, experience and a favorable regulatory history, among other factors. The inclusion of a financial advisor within the Women’s Choice Award Financial Advisor network should not be construed as an endorsement of the financial advisor by WomenCertified or its partners and affiliates and is no guarantee as to future investment success.

The LPL Financial Registered Representative associated with this site may only discuss and/or transact securities business with residents of the following states:

AL, CO, FL, GA, IN, KY, MD, MI, NC, OH, RI, SC, TN, TX, VA.