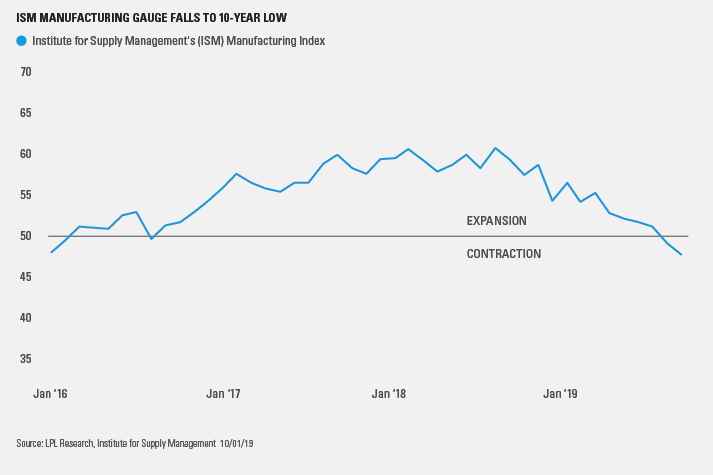

U.S. manufacturing activity fell to a 10-year low, dragged down by a weakening global economy.

The Institute for Supply Management’s (ISM) Purchasing Managers’ Index (PMI) fell to 47.6 in September, the lowest level since June 2009. As shown in the LPL Chart of the Day, the gauge stayed in contractionary territory (below 50) for a second straight month.

Underlying data in the ISM report showed tepid global demand continued to weigh on domestic manufacturing. ISM’s gauge of new orders was largely unchanged, but new export orders dropped to the lowest level of the economic cycle.

“Trade tensions have curbed global demand and stalled global manufacturing,” said LPL Financial Chief Investment Strategist John Lynch. “Even though manufacturing plays a relatively small role in the U.S. economy, it has historically been a bellwether for economic growth and corporate profits, so the recent decline could signal slowing growth ahead.”

The October 1 ISM report could also signal impending weakness in the labor market. ISM’s employment index fell to 46.3 in September, the lowest level since January 2016. Declining employment in the manufacturing sector could be a bad omen for the September jobs report, which is scheduled to be released October 4. Jobs growth has remained steady this year, but manufacturing payrolls growth has declined noticeably.

Overall, we’re watching to see if the weakness in manufacturing spreads to other areas of the U.S. economy. So far, the services sector remains in expansion, even though it has slowed in recent months, and consumer spending has adequately propped up economic growth. However, the cracks in the economic foundation are spreading, and we don’t expect any meaningful improvement in global manufacturing until we see a U.S.-China trade deal.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (Member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

| Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit |

For Public Use | Tracking # 1-899490