TRIMMING OUR 2019 GDP FORECAST

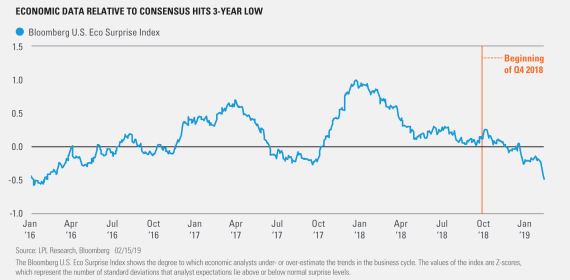

Economic data have consistently missed expectations recently as investors and Wall Street have struggled to quantify the impact of global trade and political risks.

As shown in the LPL Chart of the Day, the Bloomberg U.S. Economic Surprise Index has dropped sharply over the past few months, showing the degree to which consensus estimates have been overestimating economic trends.

December’s retail sales report was just the latest instance in a string of whiffs for consensus predictions. Retail sales unexpectedly fell 1.2% in the month, missing consensus estimates for a 0.1% gain by the widest margin since March 2009 and sparking questions about the report’s accuracy.

In response, over the past few months economists have cut their fourth quarter 2018 gross domestic product (GDP) forecasts to a range of 1.5–2.5%. If fourth-quarter GDP growth ends up at the lower end of that range, it would be the slowest pace of GDP growth since the fourth quarter of 2015.

We’ve also seen enough evidence to think 2019 GDP growth is likely to be closer to the lower end of our original 2019 forecast (2.5–2.75%), with risks balanced to the upside and downside. Even though we’ve slightly lowered our growth expectations, we still expect the core Consumer Price Index (CPI) to grow 2.25–2.5% in 2019.

“Heightened trade and political uncertainty have clearly weighed on corporate and consumer sentiment, which we think may weigh on U.S. output growth this year,” said LPL Research Chief Investment Strategist John Lynch. “Still, we think a slight increase in inflation would make sense given the firm U.S. labor market and the possibility that economic activity could stabilize after trade headwinds subside.”

As we mentioned in our Outlook 2019, we still believe stronger growth in business spending may drive this leg of the economic expansion, as higher investment leads to greater worker productivity and profit growth. However, investment may be muted until the trade dispute with China is resolved.

For more details on our revised forecasts, check out this week’s Weekly Economic Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.