The Year of the Pig Could Have Bulls Smiling

“Bulls make money, bears make money, and pigs get slaughtered.” Old Wall Street saying.

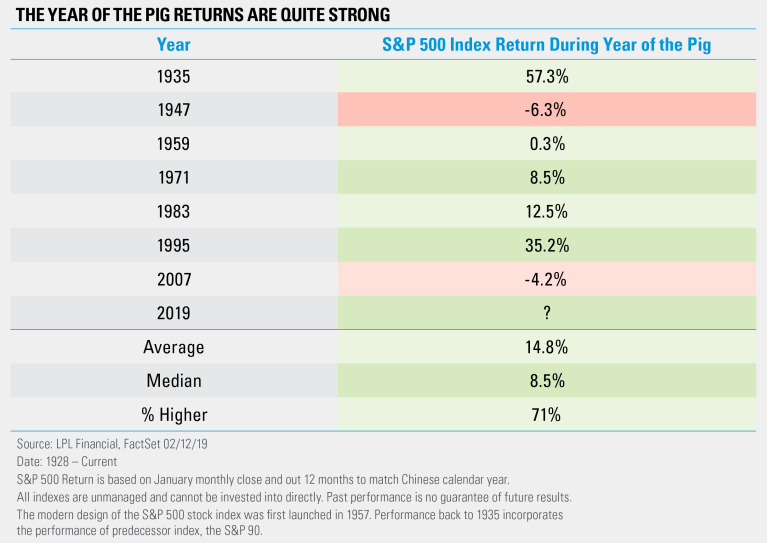

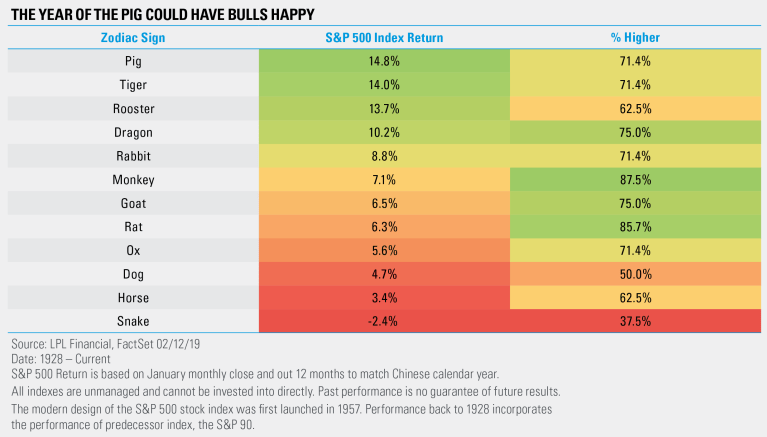

The Chinese New Year (often called the Lunar New Year) kicked off Tuesday, February 5, and with it came the Year of the Pig. Although we would never suggest investing based on the zodiac signs—it is important to note that the Year of the Pig has historically been quite strong for equities.

Since the Chinese New Year typically starts between late-January and mid-February, we looked at the 12-month return of the S&P 500 Index starting in late January dating all the way back to 1928.* And wouldn’t you know it? The Year of the Pig is up nearly 15% on average. Oink oink indeed!

“The year of the pig is the twelfth of the 12 animal signs of the Chinese zodiac, and the pig is considered a symbol of wealth in Chinese culture, which is quite interesting given some strong equity returns have taken place during this year. In fact, out of the 12 zodiac signs, no year sports a better average return,” explained LPL Senior Market Strategist Ryan Detrick.

Be aware that a small sample size and the pure randomness of this makes us want to stress not to ever invest purely based on the zodiac signs. Still, here’s to the year of the pig playing out for the bulls once again!

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.