Market Fears and Economic Realities

Recent Federal Reserve (Fed) rhetoric has spooked financial markets, especially as uncertainty has clouded investors’ horizons. But we still believe the fundamental U.S. economic landscape is compelling, and despite market concerns, an important measure of market interest rates suggests that monetary policy remains accommodative.

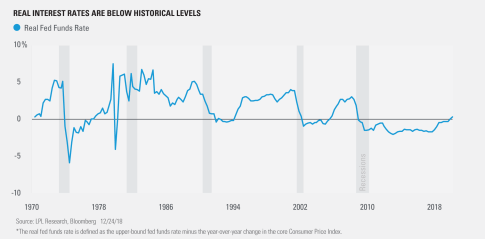

As shown in the LPL Chart of the Day, inflation-adjusted interest rates are still comparatively low and well below levels that historically have preceded economic recessions. Currently, the real fed funds rate sits at 0.3% (based on year-over-year core Consumer Price Index [CPI] growth of 2.2%), below the 1.3% real interest rate we’ve averaged since the end of 1970. During that same period, the real interest rate reached an average high of 4.2% before the U.S. economy entered a recession, significantly above where rates are today.

“There is a disconnect between U.S. economic data and pessimism priced into financial markets,” said LPL Research Chief Investment Strategist John Lynch. “The U.S. economy is strong enough to operate at current rates, and we expect the Fed to be pragmatic and flexible enough to guide us to a soft landing.”

This has been one of the most challenging market environments to navigate since the end of the Great Recession. However, we believe strong fundamentals are still in place, and the Fed’s plans remain supportive to the economic environment. While the uncertainty has been uncomfortable, the Fed remains data-dependent, leading us to expect two rate hikes in 2019. We elaborate more on our predictions for this year in our 2019 Outlook, Fundamental: How to Focus on What Really Matters in the Markets.

For more of our thoughts on recent economic trends, check out our newest Weekly Economic Commentary: Market Fears and Economic Realities.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.

Member FINRA/SIPC