Main Street’s Uncertainty Climbs

Recent U.S. economic data have been sending a lot of conflicting signals, and Wall Street’s economic outlook is more clouded than at any point of the cycle. Because of this, we thought we’d provide some direction from Main Street via the latest Federal Reserve’s (Fed) Beige Book survey, which was published January 16 and compiled in the weeks before January 7.

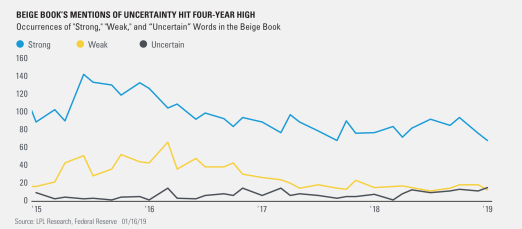

As shown in the LPL Chart of the Day, Main Street is finding it more difficult to characterize current economic conditions and set expectations. While sentiment is still healthy, mentions of uncertainty in the Beige Book climbed to the highest in at least four years, while strong and weak words both declined.

Respondents cited uncertainty around trade, politics, financial markets, and global economic conditions. Recently, this uncertainty has bled into economic data. Gauges of manufacturing activity, which are leading indicators for the U.S. economy, have slowed sharply as businesses delay expansion plans and capital investment while they wait for resolutions to the headwinds. To us, though, all the fundamental pieces are still in place for a continued expansion.

“The growing uncertainty has been tough to ignore, but Main Street’s view of the economy remains relatively upbeat,” said LPL Research Chief Investment Strategist John Lynch. “We still see a compelling argument for moderate economic growth due to strong consumer demand, modestly accelerating wages, and a robust labor market.”

As mentioned in our Outlook 2019: FUNDAMENTAL: How to Focus on What Really Matters in the Markets, we expect U.S. gross domestic product growth of 2.5%–2.75% in 2019. Capital spending growth is an important part of our economic outlook (as it leads to increased productivity and contained labor costs), and we still expect business investment to increase this year. We see trade tensions as the primary roadblock to sentiment, and we expect the United States and China to reach a deal soon, eliminating a great deal of current uncertainty and allowing companies to resume their expansion plans.

For more analysis on the most recent Beige Book, check out this week’s Weekly Economic Commentary.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

The investment products sold through LPL Financial are not insured deposits and are not FDIC/NCUA insured. These products are not Bank/Credit Union obligations and are not endorsed, recommended or guaranteed by any Bank/Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible.