Four Fed Hikes, One Year Later

The Federal Reserve’s (Fed) final policy meeting of 2019 starts today and will conclude tomorrow with the release of the Fed’s policy statement, updated economic projections, and a press conference by Fed Chair Jerome Powell. After lowering its main policy rate at each of its last three meetings, the Fed is widely expected to pause as it gauges the impact of the recent cuts and the state of the economy.

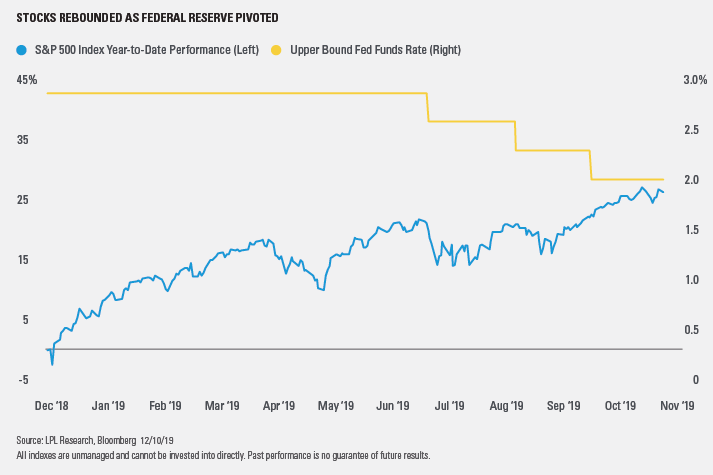

It was a little less than a year ago, on December 19, 2018, that the Fed announced the fourth rate hike of 2018 and the ninth of the current expansion. Markets roundly jeered the move. The S&P 500 Index, already down more than 13% from its all-time high in September 2018, fell to 19.8% off the all-time high by December 24, just a hair below the customary 20% decline that marks a bear market. The Fed quickly adjusted its messaging and, as shown in the LPL Research Chart of the Day, the S&P 500 has climbed nearly 25% year to date.

While appearing to be reasonable based on data available at the time, in retrospect, that fourth rate hike may look like a mistake. What have we and the Fed learned in the past year?

- Market signals matter. We don’t want markets to drive the Fed, but markets can provide useful feedback that economic data misses. Markets were signaling that rates were likely too high for the environment we were in.

- Trade uncertainty has weighed on the U.S. and global economy more than expected, and the Fed probably underestimated the impact.

- There was still some slack in labor markets, and inflation remains contained for now. Weaker growth has kept inflation in check and has easily outweighed the price impact of tariffs.

“There’s a learning curve for every Fed chair, and Jerome Powell has been no exception,” commented LPL Research Chief Investment Strategist John Lynch. “But we’ve been encouraged by the Fed’s policy approach in 2019 and think that a pause is appropriate given the more positive signals we’re getting on the economy.”

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. The economic forecasts set forth in this material may not develop as predicted.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk in all market environments.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (Member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL is not an affiliate of and makes no representation with respect to such entity.

If your advisor is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

| Not insured by FDIC or NCUA/NCUSIF or Any Other Government Agency | Not Bank/Credit Union Guarantee | Not Bank/Credit Union Deposits or Obligations| May Lose Value |

For Public Use | Tracking #1-925758